Marketing & Strategy

Transforming ‘channels’ in clinician engagement – second in a series

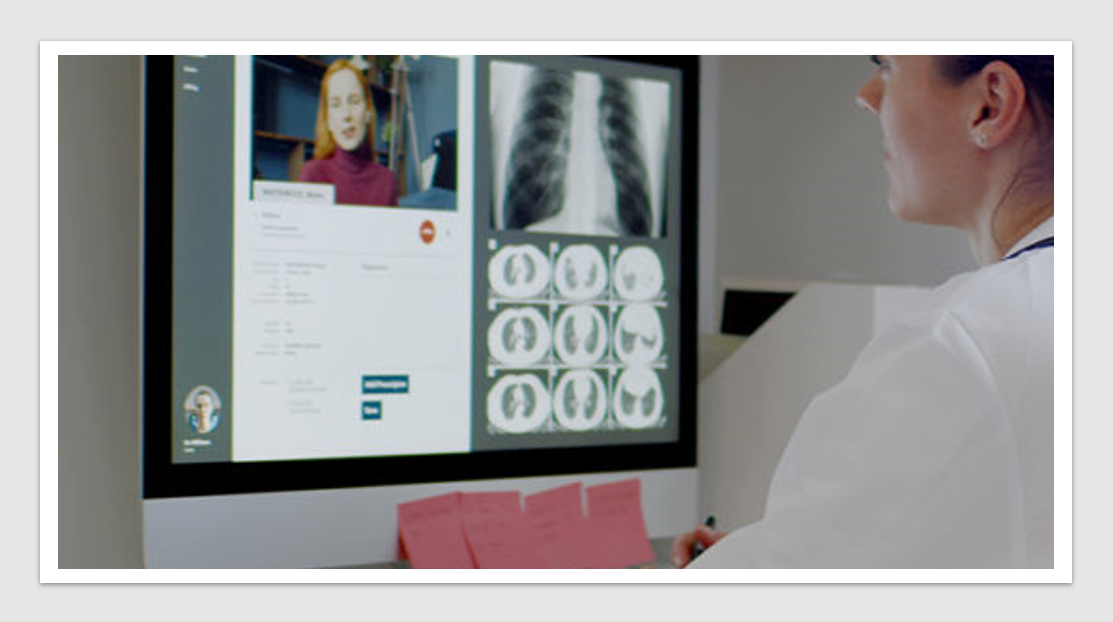

Marketing & Strategy: In this second piece in a series, we share the variety of channels being accessed by healthcare professionals (HCPs) and supplied by pharma for scientific information and education.

Based on a multi-stakeholder report which explored how the HCP-pharma engagement should evolve as we emerge from the pandemic, the survey assessed the gaps between HCP channel preferences and pharma channel focus, funding models and resource allocation by channel, and channel evolution.

HCPs rank journals, independent websites and scientific congresses as their most important sources of information, with pharma channels and social media being least important. In comparison, pharma organisations consider MSLs and field forces as most important for delivering information to HCPs, followed by scientific congresses, and rank all types of medical websites among the least important of channels.

Over 80% of HCPs consider global, independent medical websites a ‘very important’ or ‘critical’ source of scientific content, versus less than half of pharma believing the same.

HCPs consider scientific meetings, search engines and email notifications most important for discovering scientific information. They consider pharma field forces and online banner advertising least important. However, pharma rely most heavily on field forces for making HCPs aware of scientific content. Sixty-eight percent (68%) of pharma consider pharma field force activities ‘critical’ for discovery of scientific content, while only 4% of HCPs agree with this.

Pharma funding is directed primarily into pharma’s own channels rather than sponsoring or grant-funding third-party and independent channels. Budgets towards CME and third-party websites rank the lowest for pharma companies.

In the feedback, one HCPs said “Independent eliminates bias in providing medical knowledge.” Another added “Company websites will always be

regarded as pure advertisement. To be medically independent, they can collaborate with others.”

Interestingly, pharma teams expect budget increases for HCP engagement across every channel in 2022. More than half of pharma expect an increase in budget for hybrid and virtual scientific meetings allowing them to reach more customers, for development or enhancement of their own HCP websites, and social media activities.

HCPs value independent channels more highly than pharma channels but pharma strongly prioritises investment in owned channels. Use a higher balance of independent channels to provide HCPs with the trusted educational content that they value.

The priority that pharma give to field force activities is far removed from the value that HCPs attributes to them. Evolve field force activities to achieve more meaningful interactions and value for HCPs or divert efforts to channels that HCPs value more.

One survey participant within pharma said “You absolutely still need a sales force. So now think: when would you implement a sales force? Traditionally, we implemented a sales force to do outreach, awareness, disease education, and also selling the product. I think there’s an opportunity to use as much of the digital channel space to do the earlier part of the customer journey, then when a sales representative is in front of a customer, they can actually just focus on sales … Perhaps this is our opportunity to truly invest in their training, in their selling skills, and their negotiation skills.”

Another noted “It will involve a field force that are thinking in a different way about engagement and developing a different set of skills, moving to more of a customer experience mindset. It’s no longer about who shouts loudest and swamps [the] market with reps. It’s about the quality of that interaction maybe with fewer reps.”

The global study (including the APAC region) was delivered by Medthority in late 2021. Participants included more than 240+ HCPs across 30 specialties, 80+ pharma companies and 80+ service providers/vendors.

Digital & Innovation

Medical drone to reduce health equity gaps in rural and remote Australia

A specialised medical drone which increases accessibility to essential health services such as pathology, medicines, and telehealth services in rural […]

MoreNews & Trends - Pharmaceuticals

We’ve spent more on healthcare, but it’s been worth it

Healthcare expenditure is surging, with Australia now allocating approximately one-tenth of its budget to this sector. This financial uptick prompts […]

MoreNews & Trends - Pharmaceuticals

New partnership to raise the bar in precision oncology in Queensland

Pharma News: The Australian Translational Genomics Centre (ATGC) is teaming up with non-profit research organisation Omico and the PrOSPeCT program […]

MoreNews & Trends - Biotechnology

AusBiotech appoints new CEO: Former Sanofi corporate affairs and sustainability leader takes the helm

Biotech News: AusBiotech, the nation’s leading industry body for the biotech sector, has named former leader at Sanofi, Rebekah Cassidy, […]

More